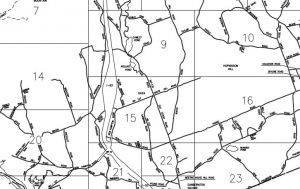

Rye, NH - Statistical Revaluation Information

The Town of Rye, NH has contracted with Municipal Resources to conduct a town wide statistical revaluation of properties effective April 1, 2017. MRI used the sale of properties from April 1, 2015 through March 1, 2017 as the starting point to establish new values. All qualified sales in this period were visited by MRI staff to ensure that the most accurate information is used in determining values. A drive by field review of all properties in town was completed to ensure accuracy and allow MRI staff to review the different neighborhoods for consistency as compared to the sale properties.

A letter was sent to all property owners containing the property’s newly established preliminary value. If desired, property owners may schedule an informal hearing to discuss the preliminary value. Information will be available so that property owners can verify the information on their property, compare their property to other comparable properties and ask questions about the revaluation process. Once the informal hearings are complete, final values will be presented to the Board of Selectmen in late August for approval.

After the informal hearing process, if any property owner believes their assessment is incorrect and wishes to file for abatement, they shall first appeal to the local assessing officials in writing, by March 1st, following the notice of tax and not afterwards. The assessing office will have the necessary form which must be completed in full.

Proposed Values:

Follow this link to schedule an appointment.

Revaluation FAQ's (courtesy of NHAAO)

1. What is a revaluation?

A revaluation is an update of all assessments in the municipality conducted under the direction of the local assessor. The assessor is a state-certified individual whose duties are to discover, list and value all taxable real property in the municipality, in a uniform and equitable manner. The assessor is not involved in the collection of property taxes.

2. Why is a revaluation necessary?

The state requires that all property in a municipality be assessed at its "full and true" market value. Further the NH Constitution (Part 2 Article 6) requires that each municipality takes value anew every five years. A revaluation is the most equitable way to accomplish this.

3. Will all property values change?

Most likely, yes. However, not all property values will change at the same rate. Market value will have decreased more for some neighborhoods and property types than for others. Some neighborhoods and property types may have increased in value and others may have remained the same. One purpose of a revaluation is to make sure that the assessed values reflect the changes that have occurred in property values.

4. Who will do the revaluation?

The municipality has choice of putting the project out to bid by a qualified firm, or handling the task in-house using existing appraisal staff. In either case, the staff has many years of experience in revaluation work and has performed revaluations for many other municipalities.

5. When will the revaluation start?

If the community is using an outside firm, this will vary according to the terms of the contract. If the project is being handled in-house, it will be dictated, to some degree, by the number of staff persons assigned to the project and the time allocated to accomplish the task. In either case, the resulting values will be effective as of April 1.

6. Is it necessary that you view the inside of my property?

To make a proper assessment on a building, it is desirable that an inspector see the inside as well as the outside of the property. The law requires that property be valued from an actual view or the best information available. Records do not always reflect current data on the physical characteristics of each property in the municipality.

7. What if I refuse to let assessment personnel in my property?

To ensure an accurate assessment, it is to your advantage to allow the inspector inside your property when an inspection is requested. When access to a property is not permitted or obtainable, the elements that comprise your assessment will need to be estimated, which may result in an incorrect final opinion of value.

8. You mention market value. What is it?

State law requires that your property be assessed at market value. Market value is defined as the amount a typical, well-informed purchaser would be willing to pay for a property. For a sale to be a market value (arm's-length) sale, the seller and buyer must be unrelated and willing parties (not under pressure) to sell or buy, the property must be on the market for a reasonable length of time, the payment must be made in cash or its equivalent, and the financing must be typical for that type of property. RSA 75:1 further defines market value as: "... the property's full and true value as the same would be appraised in payment of a just debt due from a solvent debtor."

9. What if there hasn't been a recent arm's-length sale of my property?

The next best evidence is the arm's-length sales of reasonably comparable properties. These are properties similar to yours in location, age, style, condition, and other features that affect market value, such as the number of bathrooms and size of garage.

10. What if there are no reasonable comparable sales?

The appraiser(s) will then consider all other factors that may affect the market value of your property. The cost to replace your building, less any depreciation, plus the value of land could also be used to estimate market value. For rental properties, the income and expenses of the real estate could be considered.

11. I recently built my home. Will the actual construction costs be considered?

Your construction cost is a historical figure that may or may not reflect the current market value of your property. It is only one element that will be considered.

12. What will happen to my assessment if I improve my property?

Generally speaking improvements that increase the market value of a property will increase the assessment. The following examples are typical items that may increase the assessed value of your property.

· added rooms or garage · aluminum or vinyl siding · substantial modernization of kitchen or baths · central air-conditioning · fireplaces · extensive remodeling

13. Will my assessment go up if I repair my property?

Normal maintenance will help retain the market value of your property, but generally will not affect your assessment in a significant way.

14. How can my assessment change when I haven't done anything to my property?

General economic conditions such as interest rates, inflation rates, and changes in the tax laws will influence the value of real estate. As property values change in the marketplace, those changes must be reflected on the assessment roll.

15. Do all assessments change at the same rate?

There are differences between individual properties and between neighborhoods. In one area, the sales may indicate a substantial increase in value in a given year. In another neighborhood, there may be no change, or even a decrease in property values.

16. Will the person who inspects my property be able to tell me my new assessment?

No. After the inspection of your property, appraisers have to analyze all of the information gathered before placing a value on your property. They will then further review this information to ensure that your assessment corresponds fairly to the assessments of other properties.

17. Will I be notified if there is a change in my assessment?

State of NH, Department of Revenue Administration, Administrative Rules require that all property owners be notified of their assessment regardless of value during a revaluation.

18. What if I don't agree with my assessment?

Schedule an appointment with a hearings officer. During this informal session you can learn how your assessment was made, what factors were considered, and what type of records there are on your property.

19. What if, after this informal hearing, I still disagree with the assessment?

If any property owner believes their assessment is incorrect and wishes to file for abatement, they shall first appeal to the local assessing officials in writing, by March 1st, following the notice of tax and not afterwards. The assessing office will have the necessary form which must be completed in full.

20. What if, after this formal review with the assessor, I still disagree with the assessment?

You should arrange to appear before the Board of Tax and Land Appeals or Superior Court. The assessing office can provide you with an objection form to the Board of Tax and Land Appeals that you must complete in full. You will then be scheduled for a hearing at the Board of Tax and Land Appeals. The Board of Tax and Land Appeals operates like a court, but is not as formal. It can hear only sworn oral testimony and will hear testimony from you or your representative and from the assessor.

21. What evidence do I need to present to the Board of Tax and Land Appeals?

State law puts the burden of proof on the property owner to show that the assessment is incorrect. Keep in mind that your proof must be strong enough to prove that the assessor's value is incorrect. Only relevant testimony given at the hearing will be considered by the board. Stating that property taxes are too high is not relevant testimony. You should establish in your mind what you think your property is worth. The best evidence of this would be a recent sale price of your property. The next best evidence of this would be recent sales prices of properties that are similar to yours. The closer in proximity and similarity, the better the evidence. Another type of evidence is oral testimony from a witness who has made a recent appraisal of your property.

22. What happens after the Board of Tax and Land Appeals makes its decision?

The board will either give or mail you a notice of its decision. If you are not happy with the board's determination, the notice will contain information on how you may file for reconsideration of the board's decision.

23. How will my taxes change as a result of the new assessment?

Although the value of your property affects your share of taxes, the actual amount you pay is determined by the budget needs of the schools, municipality, county, sewer district, etc. All of these taxing units decide what services they will provide in the coming year and how much money they will need to provide these services. These items are then presented to your City Council or Town Meeting, School Board and County Commissioners for approval or disapproval. Once the decision to approve a budget is made, a tax rate is set by the state that will generate the needed dollars. Your property taxes are then determined by taking your assessment, dividing by 1000, and multiplying by the tax rate. (assessed value/1000) x tax rate = taxes